Heh. The first one is, I made it! I haven't used the credit card for over a year. And, until maybe this month, I haven't even been tempted. Living on a budget works.... if you stick to it. We have come a long way. I am proud of what we have accomplished, though at the same time, I feel beaten up. It is hard, now especially, to stick to the budget, and I have been overspending lately.

We found out we are having a boy. Even though I wanted a girl, just knowing this suddenly made the pregnancy so much more real. I also started feeling him move in the last few weeks, and have started really showing in the last week or so (though I really just look really fat, I think). I am wanting to buy stuff for the baby and worrying about big ticket items. I have been going over budget and my account is suffering for it. BUT I drew the line at the credit card. I did spend some money that was sitting in my account for car repairs, though. And it isn't like I went crazy... I bought some clearance clothes at Target and some cloth diapers and I am making the nursery linens, so I bought fabric (which I still don't have enough of). But when you are on a tight budget, and when I really have myself focused on being able to pay a lot off this summer, it is hard to carve out even a little bit.

We have also gotten hit at work - Neither one of us got bonuses or raises. Although, my husband's job has "promised" retoractive raises and bonuses in June. He thinks this means layoffs are coming, though it is unlikely he will be laid off. In addition, our insurance premiums are skyrocketing. They are going up $150 in January and another $150 when the baby comes, so we are essentially taking a big paycut. I don't know what is up with my job. They refuse to admit we are hurting, but it is a huge deal that we got screwed in both raises and bonuses and we saw several large rounds of layoffs this year. I also feel I am terribly underpaid for what I do for them, and feel I deserve an additional raise to balance that out. I was surprised I didn't get it, and am debating at what point I need to ask for it. I just feel I am not in a bargaining position right now. That may change next fall. I really think I will be looking for another job by then, not just because of money but also because I spend 2-3 hours commuting everyday. I am having a hard time justifying that knowing I will have a baby this time next year. I keep playing with the stay at home scenario budget, but I just can't do it. Not only do I not really want to be a stay at home mom, we would be cut to nothing. I don't think it is worth it. It is worth it to find a better paying and/or closer to home job though, even though I ultimately love my job and am very comfortable there.

Making things worse, my laptop finally gave up the ghost this weekend. My husband keeps talking about getting me a new one, but I hate spending that money. All I can think about are all the other expenses we have coming up.

Looking back, I said there were three things, I think, that I wouldn't be able to do and still pay off debt:

1. Buy dolls: Well, I did. I am not entirely sure, but I think I bought three dolls this year, and minimal doll accessories. While this is certainly more than zero, it is a whole lot less than the several hundred dollars a month I was spending before. There have been many things I have had to pass on and watch retire, even though I really wanted it. There's always ebay? It did get easier once I got pregnant, though. It is a lot harder to justify these sorts of purchases knowing I need things like cribs and bottles.

2. Get a dog: Well, I did. Barely made it a few months on that one. He was expensive initially, and has been lately because I am taking him to training classes before the baby comes. But, overall, he has not been an overwhelming financial impact. I think after having such an old, sick, expensive dog for so long, I forget that the younger ones aren't generally as expensive. We have also built up a good savings fund for pet expenses. With everyone's shots coming due in the next few months, I am much more calm about handling that than I was this time last year.

3. No 5th anniversary in Hawaii: Yeah. We had to let this one go. There was no way. We did spend a nice week at my parent's beach house using money we saved for that purpose. I spent a lot of time on the beach, reading books, and getting pregnant. :) Maybe for our 10th we can do Hawaii?

4. No baby: Well, I did. Well.... I will. My arrangement with myself was that we would start trying once the credit cards were paid off, which is what we did. It took a few months to get pregnant, which allowed me to also pay off one of the loans. It did not take anywhere near as much time as I thought it would though. I thought we would be seeking medical treatments at this point, but I guess we were very lucky that it did not come to that. It does, however, throw off my 14 month to debt freedom plan, and I have had a hard time dealing with the realities of that. I hate stretching the money stuff out so much longer, and baby expenses, daycare, and maternity leave are all going to make it even longer.

So. I guess the lesson here is that even though you get on a budget, and by definition you have to sacrifice, you do not have to pass on the important things. I was still able to get some fun things - not as much as I wanted to or would have a year ago, but didn't have to give it up entirely. And the important things, like animals and babies, can still be worked in and worked around. You just have to be flexible and plan.

I think back to the first few months, when we were really getting by on nothing. When buying my book club book was my entire "fun money" allotment. When a month with five weeks cropped up and we ran out of gas and grocery money. When I had to pay vet bills with no pet fund cushion. When a leaking roof was the end of the world. When a hotel and plane for my cousin's wedding was a huge deal. I am griping about how low our sinking fund is now that we used it for it's purpose: Christmas gifts. But I am still entering January with around $300 in it, which is $300 more than I had last January! We have been through a lot, and we have come a long way, and we have been able to increase things, like gas and fun money, as things have been paid off or income increased (fat chance).

This has gotten long, so I suppose I will post my looking ahead thoughts separately.

Thursday, December 30, 2010

Payoff: Month 12 & year end review

November:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 7871.85

Loan 3: 9264.81

Debt: 17136.66

Paid: 769.43

December:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 7311.85

Loan 3: 9071.73

Debt: 16383.58

Paid: 753.08

Total Paid: 27524.3

Added to savings: 1600

Total Savings: ~8850

We finish out the year with 62% of our debt paid off. We have almost $9000 saved now, which would have gone on our debt as well (proving we would have wiped out at least one more loan at this point). This is an average of just under $2300 in debt repayment per month (not including our additional savings). Under the current circumstances, I cannot quite predict a projection based on this information. We will not be able to put that much per month going ahead, and I am not sure how much of our savings will be used by the time I come off maternity leave. My soft goal is to have the debts paid off by this time next year at the latest, but that will move as other things become more clear. I am confident that if we had proceeded without pregnancy, we would have met or exceeded the April 2011 goal. I don't have the actual paperwork on this with me right now, but we have also paid off around $14400 in mortgage principal this year as well. I will try to remember to check on that and update it.

Labels:

debt,

December,

money,

mortgage,

numbers,

paying off,

savings,

year-end review

Sunday, December 12, 2010

December Budget

Income: We expect to get Christmas money and I should get a bonus at work. So far neither has happened. These may get carried over onto January's budget.

Income: We expect to get Christmas money and I should get a bonus at work. So far neither has happened. These may get carried over onto January's budget.Expenses: The ususal

Debt repayment: Minimums

Variable expenses:I added $50 for the angel tree child at work.

Funds: Our flex money has run out, so I have had to pay for some doctor visits out of pocket. I am reimbursing myself from the money we would have saved, since that is what the saved money is meant to be for anyway.

Save:only $1600 this month.

November Budget

Expenses: Termite due this month. We've had some unpredictably high power bills, so I am just keeping the budget for that at 300. I figure it will all even out, as I seem incapable of telling which months will be high and which low. I guess next year I will have this year's bills to refer back to.

Debt: Continuing minimum payments to my dad and school loan.

Variable expenses: Nothing too unusual here.

Funds: Added a baby fund (And actually, I think I later upped it to $100) for buying baby stuff.

Save: Adding $1750 to savings this month.

Monday, November 22, 2010

Payoff: Month 11

October:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8431.85

Loan 3: 9474.24

Debt: 17906.09

Paid: 750.66

November:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 7871.85

Loan 3: 9264.81

Debt: 17136.66

Paid: 769.43

Total Paid: 26771.22

Added to savings: 1750

Total Savings: ~7250

As you can see from the last couple of posts, we have scaled back on our debt repayment. I am currently paying $560 to loan 2 and $250 to loan 3. Anything else which would go to these loans are going into savings. Our savings should start building quickly. I will have the OB paid in January, but I still don't know what the hospital will cost or how my maternity will work out. Once all that is taken care of, we will pay the debt again with whatever is left.

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8431.85

Loan 3: 9474.24

Debt: 17906.09

Paid: 750.66

November:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 7871.85

Loan 3: 9264.81

Debt: 17136.66

Paid: 769.43

Total Paid: 26771.22

Added to savings: 1750

Total Savings: ~7250

As you can see from the last couple of posts, we have scaled back on our debt repayment. I am currently paying $560 to loan 2 and $250 to loan 3. Anything else which would go to these loans are going into savings. Our savings should start building quickly. I will have the OB paid in January, but I still don't know what the hospital will cost or how my maternity will work out. Once all that is taken care of, we will pay the debt again with whatever is left.

Labels:

debt,

November,

numbers,

paying off,

savings

Payoff: Month 10

September

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8991.85

Loan 3: 9664.90

Debt: 18656.75

Paid: 1995.93

October:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8431.85

Loan 3: 9474.24

Debt: 17906.09

Paid: 750.66

Total Paid: 26001.79

Added to savings: 2000

Total Savings: ~5500

Saturday, October 16, 2010

September Budget

September

SeptemberHi, yes, I know what month it is.

Things, as always, are crazy. My mother had major foot surgery over a month ago and I have been staying with her to help take care of her. Time at home has been intermittent and filled with laundry and not much else.

We are also slowly trying to prepare for Baby so, while I am home this weekend, we have been cleaning out the garage and the office, into which I am (hoping) going to move all the doll stuff, as the baby is going to go in the doll room. We have so much crap. I don't want to tell you how many HUGE boxes of packing peanuts I took out of my garage. Not to mention all the cardboard, aluminum and paper. By the time we got to actual boxes with actual stuff in it, we were beat and called it a day. I put the stuff on freecycle, and what isn't taken will go into recycling over the next few weeks. We had a crappy curbside recycling program until this summer, so we used to haul it ourselves. We stopped doing that regularly, and it started piling up. When our trash service got changed to one that would take these things, we were just putting out what we were actually accumulating on a weekly basis and never got to the stores of stuff in the garage.

So, anyway....

Income: as normal

Fixed Expenses: Power has been high. No Termite or insurance this month, so extra money in other areas.

Debt: Just down to the last two. Large payment to the student loan.

Variable: I finally have a clothing fund. We had our convention, so I had some money for that. Smugmug renewal. I cut the amount for our lawn boy, as we probably won't be seeing him again til spring.

Our account balances were getting low, so I set some money aside to build them back up again. Somehow, that didn't work out quite as I planned, as my account is still reconciling negative. Hoping to float til the holidays, when we should see some extra money.

Sunday, October 3, 2010

Payoff: Month 9

August:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 11100.83

Loan 3: 9551.85

Debt: 20652.68

Paid: 2592.48

September

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8991.85

Loan 3: 9664.90

Debt: 18656.75

Paid: 1995.93

Total Paid: 25251.13

I think I flipped what is loan "2" and "3" again. We paid less this month in order to bring up our waning bank balances. We also had an event over labor day weekend that I budgeted money for. We have crossed 25,000 paid ! We paid off the small loan! We have two loans and less than 20,000 left! This would all be very exciting, however, with the baby on the way we will not be seeing much movement in the debt in the coming months. I will start keeping a tally of our savings now. The goal before was to have all debts paid by April (my 35th bday). Now, we will save that money instead, and should be able to pay my dad off right after the baby is born, and pay the last loan by next December, depending on costs associated with having and daycareing the baby.

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 11100.83

Loan 3: 9551.85

Debt: 20652.68

Paid: 2592.48

September

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 8991.85

Loan 3: 9664.90

Debt: 18656.75

Paid: 1995.93

Total Paid: 25251.13

I think I flipped what is loan "2" and "3" again. We paid less this month in order to bring up our waning bank balances. We also had an event over labor day weekend that I budgeted money for. We have crossed 25,000 paid ! We paid off the small loan! We have two loans and less than 20,000 left! This would all be very exciting, however, with the baby on the way we will not be seeing much movement in the debt in the coming months. I will start keeping a tally of our savings now. The goal before was to have all debts paid by April (my 35th bday). Now, we will save that money instead, and should be able to pay my dad off right after the baby is born, and pay the last loan by next December, depending on costs associated with having and daycareing the baby.

Monday, September 6, 2010

This changes everything.

Wondering where I've been?

Quite the surprise. This is me hoping no one I actually know reads this. It took three months. While they were happening, it was starting to feel long and tedious and like it was going to go on forever. I am sure helping that along was my belief that I was not going to be able to get pregnant on my own. It is really really early. I haven't even gotten in to a doctor yet. But the tests keep getting darker and darker, and there hasn't been any blood, so I am cautiously optimistic.

Even though we had been trying for a few months, this is really the first month I was comfortable with it happening, as we are past the halfway point and have only the two debts left. Each month it took meant more debt paid off. I've been recalculating and I think we can still be debt free by the end of 2011. That is really hard for me, since we were making such progress, and it is scary adding this new, expensive, person, so late in life, with no safety nets or fabulous retirement accounts. All I can do is hope that we know enough now to make good choices and let everyone else buy us the expensive stuff :) and give up our toys. Priorities change.

We are going to finish out the month on paper as it is (with a big payment to the student loan), but I am afraid after that the debt repayment is going to stagnante for a while. We will start building up our emergency and hospital fund instead. Hopefully after the baby comes, we can make a large lump sum payment to one of the loans.

No one knows. It is really hard keeping my mouth shut.

Quite the surprise. This is me hoping no one I actually know reads this. It took three months. While they were happening, it was starting to feel long and tedious and like it was going to go on forever. I am sure helping that along was my belief that I was not going to be able to get pregnant on my own. It is really really early. I haven't even gotten in to a doctor yet. But the tests keep getting darker and darker, and there hasn't been any blood, so I am cautiously optimistic.

Even though we had been trying for a few months, this is really the first month I was comfortable with it happening, as we are past the halfway point and have only the two debts left. Each month it took meant more debt paid off. I've been recalculating and I think we can still be debt free by the end of 2011. That is really hard for me, since we were making such progress, and it is scary adding this new, expensive, person, so late in life, with no safety nets or fabulous retirement accounts. All I can do is hope that we know enough now to make good choices and let everyone else buy us the expensive stuff :) and give up our toys. Priorities change.

We are going to finish out the month on paper as it is (with a big payment to the student loan), but I am afraid after that the debt repayment is going to stagnante for a while. We will start building up our emergency and hospital fund instead. Hopefully after the baby comes, we can make a large lump sum payment to one of the loans.

No one knows. It is really hard keeping my mouth shut.

Tuesday, August 24, 2010

Payoff: Month 8

July

cc 1,2,3,4,5: 0

Loan 1: 1961.64

Loan 2: 10111.85

Loan 3: 11171.67

Debt:23245.16

Paid: 2399.61

August:

cc 1,2,3,4,5: 0

Loan 1: 0

Loan 2: 11100.83

Loan 3: 9551.85

Debt: 20652.68

Paid: 2592.48

Total Paid: 23255.20

All credit cards are done. We paid off the small student loan. I readjusted the loan to my dad back to the full length payoff amount. Will readjust when we know better when it will be paid. Excited to start hitting the student loan hard. Passed the halfway mark!! Just shy of the $20,000 mark.

Saturday, August 21, 2010

August Budget

Revenue:

I had an extra paycheck this month.

Fixed Expenses:

I was being ridiculously optimistic about power. Termite due this month.

Debt Repayment:

Pay off Student loan #1! Minimum payments to #2 and my dad.

Variable Expenses:

I gave us raises on our personal amounts this month. I put in a clothing budget (finally!!). I am desperate for new underwear. My panties all have holes and are unravelling. My underwire has popped out of my bra and is giving my bruises in my arm. Also, as we approach fall and winter, I desperately need work appropriate winter clothes. I wore the same four sweaters from November - March last year.

Funds:

Lowered our repair amount to help cover our trip and the clothing. I wanted to put all of my extra paycheck into savings, but gave some of it to cover other things.

Monday, August 16, 2010

Trip Summary

Back from our trip.

Back from our trip.While we didn't meet the individual budget goals, we came out under overall.

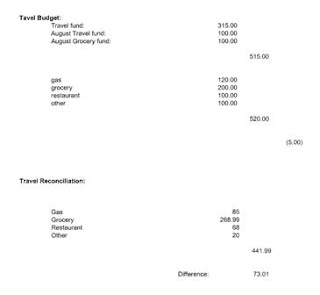

There was $415 in the travel fund in August. We added $100 of the August grocery money to that. I budgeted that money as above for gas, groceries, eating out, and a buffer.

Our stay was free, as it is a family home. We had to clean the place before we left and do some minor repairs and checking while there. We did spend some of our money (grocery) on these tasks. We only ate out once, at my favorite restaurant. Other spending in the restaurant category was for food on the road to and from. I grossly overestimated the gas spending. I think the last time I drove down there was when the gas prices were really high, and I was going off what I remembered spending that time. I also expected us to putter around more while there and need a fillup during the week. We only had to fill up at the beginning and midway each way, for under $50 each direction. I had to mail some packages while there, and that is my "other" expense. (Most of these are rounded up, by the way).

The big hit was groceries. I was shocked at the prices there, and almost no sales. We had to shop Publix, and it was freaking expensive, and like I said, no good sales. I think all the prices were inflated. Even with coupons, it was painful. Later in the week we went out to Walmart (which is much further away) but the deals there were so much better.

We still came in under budget, though I do feel I was a bit of a tightwad about it, but I don't think we suffered for it. We aren't big eater-outters anyway. $74 back into the travel jar.

Sunday, August 8, 2010

Plugging others~

This is a fellow blogger on a TTC message board I am on. She is giving away a care package including a really cool cup and some ic's. She also makes beautiful graphics. Check her out.

In related news.... We are on our 5th anniversary (non-Hawaiian) trip. I am relaxing and enjoying some time away from work drama. I love my job, but there is some petty juvenile I'm-not-your-friend stuff going on that is wearing on me, so I am glad to be away. Additionally, I should be ovulating next week, so I am hoping to give this my undivided attention this month. It would be really cool to come back with a little anniversary souvenir. I hope the stress free relaxation and copious free time will be good for our mission.

I have all my budget stuff with me. I do not have a scanner here, so posting will have to wait til I get back. We have our August budget and also a trip budget for our trip. I am going to work on the June income statement (which is mostly done) and have that ready to post when I get home. By then I should have what I need to do July too. We will be paying off the little student loan next week, so I am in a really good place with getting pregnant now. The last two loans are going to take a while, but will be doable even if we do get pregnant at this point.

Labels:

August,

baby,

budget,

Income statement,

work

Sunday, July 25, 2010

Payoff: Month 7

June:

cc 1,2,3,4: 0

cc5: 1702.95

Loan 1: 3960.03

Loan 2: 10413.44

Loan 3: 11271.30

Debt: 27347.72

Paid: 2941.27

July

cc 1,2,3,4,5: 0

Loan 1: 1961.64

Loan 2: 10111.85

Loan 3: 11171.67

Debt:23245.16

Paid: 2399.61

Total Paid: 20662.72

Yay no credit cards!! My husband made the comment when he got his statement that he didn't think he had ever seen a 0 interest amount on a statement. We also crossed the $20,000 debt paid mark and are a couple thousand from the halfway mark. On the one hand, that makes it feel much more doable, but it still seems really daunting. Is it possible that the first half is easier than the second half? Maybe because the two debts left are so large and we aren't going to see as fast results. The little loan will be paid off in a couple of weeks. I think I have recommitted to paying the student loan before my dad, which means we won't see another payoff til February, at the earliest. I also readjusted the amount due to my dad to reflect this change.

cc 1,2,3,4: 0

cc5: 1702.95

Loan 1: 3960.03

Loan 2: 10413.44

Loan 3: 11271.30

Debt: 27347.72

Paid: 2941.27

July

cc 1,2,3,4,5: 0

Loan 1: 1961.64

Loan 2: 10111.85

Loan 3: 11171.67

Debt:23245.16

Paid: 2399.61

Total Paid: 20662.72

Yay no credit cards!! My husband made the comment when he got his statement that he didn't think he had ever seen a 0 interest amount on a statement. We also crossed the $20,000 debt paid mark and are a couple thousand from the halfway mark. On the one hand, that makes it feel much more doable, but it still seems really daunting. Is it possible that the first half is easier than the second half? Maybe because the two debts left are so large and we aren't going to see as fast results. The little loan will be paid off in a couple of weeks. I think I have recommitted to paying the student loan before my dad, which means we won't see another payoff til February, at the earliest. I also readjusted the amount due to my dad to reflect this change.

Friday, July 16, 2010

Mid month check in

Lots of things going on in my life, wrapped with crappy access to the web from work and little time for updates from home.

The first thing is that I got a small raise this week. This is exciting because I did not think I was eligible for a raise this year. However, the whopping $40 isn't going to make a huge life change like my husband's raise did. At this rate, I will be back to my teaching wage in 14 years.

Work is keeping us super busy. There have been a lot of layoffs, and as a precausionary measure, my boss has started giving us all extra work to do from other departments to make us more integrated, invaluable and necessary. I don't believe any of our positions were at risk in the first place, but I appreciate the concern. I love having work. The problem is we all feel overly swamped now. And all the new stuff seems to be WE NEED THIS DONE RIGHT NOW!!! So my normal duties seem to be shoved to the side. I am a couple months behind on some bank recs because I just haven't had time to look at them. I want to ask who was doing all this super important need it now stuff, but it seems the answer is nobody, and that is the problem.

Today they informed me that I am going to start doing payroll for some of the employees. Uh... isn't that HR? Don't get me wrong, I am actually excited to do this, it just seems really random to me. We have two HR people. People have been getting their paychecks. So why does HR suddenly need to move this off their sholders? I hadn't noticed them seeming that swamped til recently (but our number of employees is going down?) but like, I'm not. Well, as I have been here now for 9 months and still haven't had a 30 day review, I take all this as good signs, at least.

On the home front, my husband and I are offically TTC (trying to conceive, for the non-baby minded). This is our second month, and I am in the "I don't know one way or the other" part of the cycle. Being the control freak I am, I have taken a very scientific approach to it all. I am charting, temping, taking ovulation tests, and a lot of other stuff you don't want to know about. Getting pregnant is not as easy as young virgins are led to believe, it turns out. And, it isn't cheap either. I have bought: a miracle baby making lube which my husband turned out to be "allergic" to, ovulation kits, pregnancy tests, a fertility bracelet, a thermometer, a subscription to a charting website (it has a cool iphone app! There really IS an app for everything!), all kinds of vitamins and medications, I have also heard geritol or robitussin work, but haven't tried those yet. Yeah....

I also have 16 million spread sheets going based on when or if we get pregnant. I am really praying we can do this on our own. And trying not to worry about that part too much yet. I am giving it til January. So I am rethinking our payoff schedule. As we are paying off the little student loan in a month, I have to know now which of the two big loans we are going to attack first. Initially, it was going to be the student loan, because that was smaller. But the payoff to my dad is bigger, so that one is smaller now. Plus, I really wanted to have him paid off. However, if we do get pregnant, our debt repayment is going to grind to a halt. We are going to have to save up til the baby comes, and after it is here, most of that money will pay for daycare and baby expenses. (This is why I really wanted to be debt free first). I feel like I want to try to pay off the student loan in this case, because if we get in a bind or have a baby, my dad is going to be a lot more understanding and forgiving than Direct Loans.

The first thing is that I got a small raise this week. This is exciting because I did not think I was eligible for a raise this year. However, the whopping $40 isn't going to make a huge life change like my husband's raise did. At this rate, I will be back to my teaching wage in 14 years.

Work is keeping us super busy. There have been a lot of layoffs, and as a precausionary measure, my boss has started giving us all extra work to do from other departments to make us more integrated, invaluable and necessary. I don't believe any of our positions were at risk in the first place, but I appreciate the concern. I love having work. The problem is we all feel overly swamped now. And all the new stuff seems to be WE NEED THIS DONE RIGHT NOW!!! So my normal duties seem to be shoved to the side. I am a couple months behind on some bank recs because I just haven't had time to look at them. I want to ask who was doing all this super important need it now stuff, but it seems the answer is nobody, and that is the problem.

Today they informed me that I am going to start doing payroll for some of the employees. Uh... isn't that HR? Don't get me wrong, I am actually excited to do this, it just seems really random to me. We have two HR people. People have been getting their paychecks. So why does HR suddenly need to move this off their sholders? I hadn't noticed them seeming that swamped til recently (but our number of employees is going down?) but like, I'm not. Well, as I have been here now for 9 months and still haven't had a 30 day review, I take all this as good signs, at least.

On the home front, my husband and I are offically TTC (trying to conceive, for the non-baby minded). This is our second month, and I am in the "I don't know one way or the other" part of the cycle. Being the control freak I am, I have taken a very scientific approach to it all. I am charting, temping, taking ovulation tests, and a lot of other stuff you don't want to know about. Getting pregnant is not as easy as young virgins are led to believe, it turns out. And, it isn't cheap either. I have bought: a miracle baby making lube which my husband turned out to be "allergic" to, ovulation kits, pregnancy tests, a fertility bracelet, a thermometer, a subscription to a charting website (it has a cool iphone app! There really IS an app for everything!), all kinds of vitamins and medications, I have also heard geritol or robitussin work, but haven't tried those yet. Yeah....

I also have 16 million spread sheets going based on when or if we get pregnant. I am really praying we can do this on our own. And trying not to worry about that part too much yet. I am giving it til January. So I am rethinking our payoff schedule. As we are paying off the little student loan in a month, I have to know now which of the two big loans we are going to attack first. Initially, it was going to be the student loan, because that was smaller. But the payoff to my dad is bigger, so that one is smaller now. Plus, I really wanted to have him paid off. However, if we do get pregnant, our debt repayment is going to grind to a halt. We are going to have to save up til the baby comes, and after it is here, most of that money will pay for daycare and baby expenses. (This is why I really wanted to be debt free first). I feel like I want to try to pay off the student loan in this case, because if we get in a bind or have a baby, my dad is going to be a lot more understanding and forgiving than Direct Loans.

Monday, July 5, 2010

May Income Statement

I really have to say, at this point, after doing this for a few months, that I really don't understand how we keep having such large net incomes. It isn't like we are gaining $2000 a month. I suppose it is from our bank balances, but even those aren't really that high. We each maintain about $350 in our accounts throughout the month. Maybe it is because we get paid at the end of the month, and haven't spent that money on bills yet when the statements are mailed? It does make sense that the end amount is $400 less than the beginning balances, because I think I got paid an extra $400 at the end of April, which we saved to pay for our hotel in May. I don't know... I just don't want to give the false impression that we are rolling in dough or that we aren't busting our budget every month, which we usually are.

I really have to say, at this point, after doing this for a few months, that I really don't understand how we keep having such large net incomes. It isn't like we are gaining $2000 a month. I suppose it is from our bank balances, but even those aren't really that high. We each maintain about $350 in our accounts throughout the month. Maybe it is because we get paid at the end of the month, and haven't spent that money on bills yet when the statements are mailed? It does make sense that the end amount is $400 less than the beginning balances, because I think I got paid an extra $400 at the end of April, which we saved to pay for our hotel in May. I don't know... I just don't want to give the false impression that we are rolling in dough or that we aren't busting our budget every month, which we usually are.Extra revenue: Birthday money

Expenses:

Yay low power! We over paid cable last month, so it is a little under this month. Termite due this month. I think netflix was double paid last month, or else I just missed it on my statement.

Debt:

Standard stuff here.

Variable:

Restaurant was high because we were out of town and had a couple of unplanned lunches. Most of our meals during the trip were covered by one relative or another. Supplies were high ... I have gotten into CVS ing. Unfortunately, some trips I get out of there for under $1, some are more like $20.

Additional expenses:

I spent almost $200 making my cousin's programs for her wedding, but my aunt offered later to reimburse me for that, which was great! That will show up in July, I think. The rest of the expenses for the wedding included our hotel, parking at the airport, and some last minute outfit additions.

Fund activity:

I have been struggling with how to handle planned expenses in the budget. I keep a separate spreadsheet with the tallies for our funds. Most things I just leave off altogether, like the boy who cuts our lawn, or our cleaning people (which my mom paid for as our Christmas gift). But I feel that I need to keep a true account of our expenses, and I also want to celebrate the fact that we actually were prepared for some things. The money isn't technically coming out of our monthly income, it is coming from our savings funds for that purpose. So, I have added "fund activity" at the bottom of the IS.

This month we took from two funds: I show the balance of the fund, the amount removed, and the new balance.

From repairs, we paid for our roof repair (YAY!) and also 2 new tires for my husband's car, since one was completely flat. From pet, we paid for my dog's boarding for our trip, which somehow tripled in planned amount, because he also had a checkup and some medicine added on.

Sunday, July 4, 2010

July Budget

Happy 4th!

Income: Standard

Fixed Expenses:

My husband's life insurance is due this month. I think that is the only unusual item here.

Debt:

We have paid off all the credit cards at this point, though some bills are still being charged to the last credit card. For now, We will just continue to pay off that card, but not use it otherwise. We are now working on the little student loan, which should be paid off in August.

Variable:

The main change here is that I upped our discretionary spending. As I have said before, after months of no fun spending and not getting items we want I feel we can finally loosen up now that the credit cards are paid off. Unfortunately, because the high insurance bills are due this month, it meant some of the funds had to be lowered as well.

A note on the June cash jars:

We spent everything this month, and then some. We have very few receipts to show for it. I am not even going to bother with this this month. We had $1 left over, which I am just throwing in for this month. Every month I say we are going to be better about this, and then things get crazy, life happens and we just aren't, and I end up pulling my hair out at the end of the month.

Wednesday, June 23, 2010

Payoff: Month 6

May

cc 1,2,3,4: 0

cc5: 3514.67

Loan 1: 4454.32

Loan 2: 10972.64

Loan 3: 11347.35

Debt: 30288.99

Paid: 3197.36

June:

cc 1,2,3,4: 0

cc5: 1702.95 *

Loan 1: 3960.03

Loan 2: 10413.44

Loan 3: 11271.30

Debt: 27347.72

Paid: 2941.27

Total Paid: 16560.16

We have paid off more than 15,000 now and have our total debt under $30000.

*While our credit card is actually paid off at this point, we won't get the statement which says so until July. This was the payoff amount on the statement in June.

cc 1,2,3,4: 0

cc5: 3514.67

Loan 1: 4454.32

Loan 2: 10972.64

Loan 3: 11347.35

Debt: 30288.99

Paid: 3197.36

June:

cc 1,2,3,4: 0

cc5: 1702.95 *

Loan 1: 3960.03

Loan 2: 10413.44

Loan 3: 11271.30

Debt: 27347.72

Paid: 2941.27

Total Paid: 16560.16

We have paid off more than 15,000 now and have our total debt under $30000.

*While our credit card is actually paid off at this point, we won't get the statement which says so until July. This was the payoff amount on the statement in June.

Saturday, June 19, 2010

Hit our first goal

We paid off our last credit card this week after payday.

Tonight, we took my family out to dinner on us. We toased Dave Ramsey, and I wore my Dave Ramsey shirt.

I paid for everyone, and I paid in cash.

My parents pay for so many meals and trips for us, it felt good to make a token reciprocation, and it was nice to go out for a bit and have a good time.

Now back to the grind... Looking ahead, we will pay off the little student loan in August, and then the rest will be more gruelling.

The credit cards were the important part for me, though.

Tonight, we took my family out to dinner on us. We toased Dave Ramsey, and I wore my Dave Ramsey shirt.

I paid for everyone, and I paid in cash.

My parents pay for so many meals and trips for us, it felt good to make a token reciprocation, and it was nice to go out for a bit and have a good time.

Now back to the grind... Looking ahead, we will pay off the little student loan in August, and then the rest will be more gruelling.

The credit cards were the important part for me, though.

Labels:

cash,

Dave Ramsey,

debt,

money,

paying off,

socializing

Friday, June 4, 2010

This is gonna be one of those posts...

I did something bad, and now I am panicking about it. It is gonna be ok. It isn't That bad. I am just beating myself up for it.

Several years ago, I was in an ebay bidding war for an OOAK doll. While I have seen many dolls by this artist (and later did get another one), this is the most beautiful one I have seen. Even though the artist usually sells her dolls for around $400, this one ended up going for around $90. I dropped out, but if I had upped my bid one more time, I would have won. I know this because as it turned out, I knew the woman who won her. She said she had also entered her last bid and walked away, as had I (I was going out) and hers was just a bit higher than mine. I have kicked myself over that for years, but took comfort in knowing where the doll ended up.

Over the years, this woman seems to have lost interest in dolls. I don't know what the deal is exactly, but she fell out of the American Girl community, and sold off a lot of that collection. She got big into Ellowyne (which is what these dolls are) and worked so much with this Ellowyne artist that she even helped to design a line of clothing with her for them. She has become close friends with her. But, she slowly over the years sold off her Ellowynes as well. She got heavy into BJDs for a while, and sold those off too. I don't understand the part where you invest heavily in these collections, lose interest, and sell. I have a very hard time selling my collections.

Anyway, she had three Ellowynes left, and the doll I had wanted was one of them. She posted them all for sale a couple weeks ago. I inquired, and she remembered that I had been bidding on this doll. She wanted $200!! I had hoped that since she got a deal on the doll, she wouldn't be pricing her so high! I told her I couldn't afford that, and she told me she would let me know if she didn't sell.

Tonight, she emailed me to tell me she was about to list her on Ebay for $150 and would I like her for $140 (+shipping, it turns out)? I have $60 in my personal spending account. But of course, there are several things I want to buy. Including clearance Ellowyne things from the company. I went back and forth on it. I can't believe she didn't sell (The other two did) and I feel like she is meant to be mine. I told her I would take her. I guess I have to start rooting around for things to sell now too.

It is very very hard living on so tight a budget. This is exactly why I planned to give us another "raise" next month. It's like dieting. You can't completely deprive yourself for such long periods of time. We don't go out, we can't buy fun things... and every little thing we have to do is a stress about the cost and the budget. It's been 6 months of this. I believe you need to let up on the reigns from time to time. It is just hard to do when I want so badly to achieve my big goal. And when things like this happen which are once-in-a-lifetime, it is hard to pass up. It is not the end of the world, or even the end of the money. It just isn't wise use of money, and it means putting off other things I was planning to get. Again. And so I beat myself up.

We will be paying off the last credit card in 10 days. We are really psyched about that. I spent some time today "what-if"ing a best case scenerio on a baby, and it really throws off everything. It is shocking how much a baby (specifically daycare) is going to slow us down. I don't know how poor people do it. But - all fodder for a different post. The point is, things happen, life happens, and I guess you have to roll with it. I feel like if we aren't going to be debt free by April, the credit cards are the important part to me, and does it really matter beyond that?

I guess even in the face of accomplishing my first goal, I am having a rough time right now. I need to feel some success at something. I am scared. Of every possible outcome.

Several years ago, I was in an ebay bidding war for an OOAK doll. While I have seen many dolls by this artist (and later did get another one), this is the most beautiful one I have seen. Even though the artist usually sells her dolls for around $400, this one ended up going for around $90. I dropped out, but if I had upped my bid one more time, I would have won. I know this because as it turned out, I knew the woman who won her. She said she had also entered her last bid and walked away, as had I (I was going out) and hers was just a bit higher than mine. I have kicked myself over that for years, but took comfort in knowing where the doll ended up.

Over the years, this woman seems to have lost interest in dolls. I don't know what the deal is exactly, but she fell out of the American Girl community, and sold off a lot of that collection. She got big into Ellowyne (which is what these dolls are) and worked so much with this Ellowyne artist that she even helped to design a line of clothing with her for them. She has become close friends with her. But, she slowly over the years sold off her Ellowynes as well. She got heavy into BJDs for a while, and sold those off too. I don't understand the part where you invest heavily in these collections, lose interest, and sell. I have a very hard time selling my collections.

Anyway, she had three Ellowynes left, and the doll I had wanted was one of them. She posted them all for sale a couple weeks ago. I inquired, and she remembered that I had been bidding on this doll. She wanted $200!! I had hoped that since she got a deal on the doll, she wouldn't be pricing her so high! I told her I couldn't afford that, and she told me she would let me know if she didn't sell.

Tonight, she emailed me to tell me she was about to list her on Ebay for $150 and would I like her for $140 (+shipping, it turns out)? I have $60 in my personal spending account. But of course, there are several things I want to buy. Including clearance Ellowyne things from the company. I went back and forth on it. I can't believe she didn't sell (The other two did) and I feel like she is meant to be mine. I told her I would take her. I guess I have to start rooting around for things to sell now too.

It is very very hard living on so tight a budget. This is exactly why I planned to give us another "raise" next month. It's like dieting. You can't completely deprive yourself for such long periods of time. We don't go out, we can't buy fun things... and every little thing we have to do is a stress about the cost and the budget. It's been 6 months of this. I believe you need to let up on the reigns from time to time. It is just hard to do when I want so badly to achieve my big goal. And when things like this happen which are once-in-a-lifetime, it is hard to pass up. It is not the end of the world, or even the end of the money. It just isn't wise use of money, and it means putting off other things I was planning to get. Again. And so I beat myself up.

We will be paying off the last credit card in 10 days. We are really psyched about that. I spent some time today "what-if"ing a best case scenerio on a baby, and it really throws off everything. It is shocking how much a baby (specifically daycare) is going to slow us down. I don't know how poor people do it. But - all fodder for a different post. The point is, things happen, life happens, and I guess you have to roll with it. I feel like if we aren't going to be debt free by April, the credit cards are the important part to me, and does it really matter beyond that?

I guess even in the face of accomplishing my first goal, I am having a rough time right now. I need to feel some success at something. I am scared. Of every possible outcome.

Tuesday, June 1, 2010

June's Budget

HAHA! Look at that! The budget up on the first day of the month! I do want to point out that I have the budgets done ... usually two months ahead of time *blush* they get tweaked a bit as time gets closer. So, its not that I am not doing them... It is that I am not getting them posted in a timely manner. Part of it is that a lot is going on at home. I have been working out after work so I get home late, and pretty much eat dinner and go to bed. The weekends have been crazy. Work no longer allows me to access blogs of any kind. And, as we got closer to the wedding, the less time I had for blogging. I am committed both to doing and posting, so it will get done. I just wish I could still do blogs from work.

HAHA! Look at that! The budget up on the first day of the month! I do want to point out that I have the budgets done ... usually two months ahead of time *blush* they get tweaked a bit as time gets closer. So, its not that I am not doing them... It is that I am not getting them posted in a timely manner. Part of it is that a lot is going on at home. I have been working out after work so I get home late, and pretty much eat dinner and go to bed. The weekends have been crazy. Work no longer allows me to access blogs of any kind. And, as we got closer to the wedding, the less time I had for blogging. I am committed both to doing and posting, so it will get done. I just wish I could still do blogs from work.Revenue

No surprises.

Fixed

My insurance installment is due again already. That surprised me. I thought I had til July. So, that took some reworking to fit that in. Power is going down, and I am really trying not to blast the AC til it gets brutally hot. Our trash may or may not be due. It normally would, so I put it in the budget, but they are saying they are going to change the trash system in our county so that it comes out of our property taxes. The bonus, though, is that there will be a ton more curbside recycling which will be amazing. So. I am hoping that is the case. But then I am not sure what, if anything, the trash bill will look like this month.

Debt

WE WILL PAY OFF THE LAST CREDIT CARD THIS MONTH!!!!!!!!!

That was my first and most important goal. I am so excited. And the first student loan should fall two months later in August, so this is really going to be an exciting few months coming up.

Variable

Expenses:

I have set aside extra money for an outing to celebrate being credit card debt free. I feel like everyone carries me a lot - We always get our dinners and stuff paid for by my family, because they know we can't/won't be able to participate in family events otherwise. It may just be a token, but I want to take them all out for dinner and drinks on me at my favorite restaurant when we pay off the credit cards. I believe we deserve a paid for in cash celebration! And it is important to me to make an effort to pay them back and a display of how responsible we are getting and turning our life around.

Funds:

Our lawn boy upped his rates this summer, and we have already burned through all the money we had saved up for him! So, I have to cash flow him. I lowered the travel and repairs funds to help cover some of the other higher expenses this month.

Don't worry too much about the notes on the side. For the most part, my fund jars were all off. I had too much in some, and not enough in others, and the bank accounts were running low because we were just paying with the debit card instead of with the cash we had set aside. So, I resorted all the money in the jars to match what should be in them, and didn't pull that money from the bank accounts in order to repay them what they were owed. Sort of. They are still going to be low, but not as.

April Income Statement

April Income Statement

Revenue:

I got an extra week's paycheck at the end of the month, which was actually brought forward to pay for the hotel in May. My inlaws paid my husband back for his expenses to travel there.

Fixed Expenses:

Power is finally going down a little bit. We couldn't find the cable bill, and even though we pay the same amount every month, my husband overpaid on purpose. Insurance is super high because we got charged 3 installments on our auto insurance and my husband and I both got life insurance. I had thought we would be charged monthly for that, but we were charged quarterly.

Debt:

We paid the planned $2000 to the last credit card, as well as the $800 for the travel expenses which were put on the card.

Variable:

We were able to include a travel fund again. The pet amount includes the $150 for the fund as well as $200 spent at the vet on the dog for his shots and grooming. We forgot to take cash. I sorted all the funds out in May. I keep a separate spreadsheet with their ins and outs and actual totals. Supplies was high this month. We did some work on our basement, which required some supplies and I needed some supplies for other projects. Bank fee was the finance charge on the credit card. My husband's discretionary was super high. He got his WOW renewed for 6 months. He also cancelled a subscription, but in the process had to pay for several issues at once. Or something.

Savings:

Not surprisingly, we had nothing for the sinking fund this month. $900 in the bank account was earmarked for repairs.

April special circumstances:

A couple of my husband's charges from his parents carried over onto the April statement. We owed $2000 to the federal taxes. We moved money out of savings to pay for that. Then we got $874 back from the state. I want to pay back the $2000 to savings, but as of yet we have not. I have really just been holding my breath to get through May, but now will look at that.

Monday, May 31, 2010

May Budget

...better late than never? I am glad this month is over, that's all I can say.

...better late than never? I am glad this month is over, that's all I can say.Revenue: Includes my husband's raise, and my extra week paycheck for this quarter.

Fixed: Termite bill due.

Debt repay: Typical amounts all around.

Variable: I have split this section up into the categories we are actually spending each month and the categories we are funding, and may or may not actually be spending. It makes it easier for me to read, plan, and analyze.

We gave ourselves a small raise in our discretionary spending. This is financed by my husband's raise, but also well deserved after a full quarter of really having no spending money, and making good debt progress. As I have started to work out more, I had wanted to buy new sneakers, but that money ended up buying mother's day flowers :/ The rest of the expenses are the same as any month.

For the funds, my husband's raise allowed us to add a car fund category. My hope is that this will build toward a new car when needed, but may end up going to car repairs if necessary. All of my extra paycheck this month was earmarked for our wedding expenses, including our stay and parking.

Tuesday, May 25, 2010

Payoff: Month 5

April

cc 1,2,3,4: 0

cc5: 6105.14

Loan 1: 4542.19

Loan 2: 11437.74

Loan 3: 11401.28

Debt: 33486.35

May

cc 1,2,3,4: 0

cc5: 3514.67

Loan 1: 4454.32

Loan 2: 10972.64

Loan 3: 11347.35

Debt: 30288.99

Paid: 3197.36

Total Paid: 13618.89

cc 1,2,3,4: 0

cc5: 6105.14

Loan 1: 4542.19

Loan 2: 11437.74

Loan 3: 11401.28

Debt: 33486.35

May

cc 1,2,3,4: 0

cc5: 3514.67

Loan 1: 4454.32

Loan 2: 10972.64

Loan 3: 11347.35

Debt: 30288.99

Paid: 3197.36

Total Paid: 13618.89

Friday, May 14, 2010

My doll arrived today!

Tuesday, May 11, 2010

UGH

Work has blocked blogger. This is new this week. I cannot post or read any bloggers from work anymore. How annoying.

We got our roof fixed. I don't have to worry about that anymore. It is done. I am glad. Onto the next thing.

My cousin called me up last minute and asked me to make wedding programs for her. At first I was going to say no (mostly for the time crunch), but I ended up saying yes. I have already spent maybe $75 on supplies, and I have run out of ink so I need to buy more. This is money I hadn't planned on spending. This is going to have to be her gift. Tight month gets tighter. We leave next week.

We are on track to pay off the credit cards mid June.

We got our roof fixed. I don't have to worry about that anymore. It is done. I am glad. Onto the next thing.

My cousin called me up last minute and asked me to make wedding programs for her. At first I was going to say no (mostly for the time crunch), but I ended up saying yes. I have already spent maybe $75 on supplies, and I have run out of ink so I need to buy more. This is money I hadn't planned on spending. This is going to have to be her gift. Tight month gets tighter. We leave next week.

We are on track to pay off the credit cards mid June.

Tuesday, May 4, 2010

Coupons

In trying to eek out everything I can, I have started researching coupons. I already feel overwhelmed by the number of coupons I have accumulated in just two weeks. My husband got very defensive when I started pushing the issue. I guess he took it personally. He has done a great job cutting our shopping costs, but I just feel it can go lower. He insists price-coupon is equivalent to store brand price. So now I am taking over the shopping. The problem is that I don't do the cooking, and I don't get home til 7 on a good day. So when am I fitting this in? He works from home, so he could always run out at lunch or after work.

It seems hard to plan everything out and spend as little as possible and match coupons to sales and know when to buy and when to wait and do without. I have also started working a drug store. I have never shopped at drug stores before. I did my first trip today:

Aleve $5.00 (save .80)

Colgate $2.99 (save .90)

Gillette Razor 9.79 (save .20)

Depends 6.99

Dawn .97 (save 1.02)

2 Nivea lipgloss 2@2.99

3 Nivea body wash 2@4.88 and 1@6.99 for some reason. They all said 4.88 under them. I didn't notice this til just now.

GBT .99

49.46 b4 tax

Coupons:

Dawn .50

Colgate .75

Aleve 1.00

Nivea lipgloss 1.00

razor 2.00

depends 2.00

lipgloss BOGO 2.99

Bodywash 4.00

bodywash 4.00

bodywash BOGO 4.88

Total: 30.86

Saved: 28.26

EB Offers:

Nivea $5

Gilette $6

Aleve $3

Depends $6.99

Colgate $2

Total: 22.99

Difference: 7.87

Not bad, and now I have all those bucks to float my future trips. One does tend to wonder how much stuff you don't need is worth buying just to have good rewards. I can at least use all of this (except the depends, which I will take to my grandmother's alzheimer's home this weekend), even if I wasn't actively looking to buy any of it. I am set for body wash for a while.

Anyway, I am going to start linking up websites I have found to be helpful, and hopefully start making dents with coupons.

It seems hard to plan everything out and spend as little as possible and match coupons to sales and know when to buy and when to wait and do without. I have also started working a drug store. I have never shopped at drug stores before. I did my first trip today:

Aleve $5.00 (save .80)

Colgate $2.99 (save .90)

Gillette Razor 9.79 (save .20)

Depends 6.99

Dawn .97 (save 1.02)

2 Nivea lipgloss 2@2.99

3 Nivea body wash 2@4.88 and 1@6.99 for some reason. They all said 4.88 under them. I didn't notice this til just now.

GBT .99

49.46 b4 tax

Coupons:

Dawn .50

Colgate .75

Aleve 1.00

Nivea lipgloss 1.00

razor 2.00

depends 2.00

lipgloss BOGO 2.99

Bodywash 4.00

bodywash 4.00

bodywash BOGO 4.88

Total: 30.86

Saved: 28.26

EB Offers:

Nivea $5

Gilette $6

Aleve $3

Depends $6.99

Colgate $2

Total: 22.99

Difference: 7.87

Not bad, and now I have all those bucks to float my future trips. One does tend to wonder how much stuff you don't need is worth buying just to have good rewards. I can at least use all of this (except the depends, which I will take to my grandmother's alzheimer's home this weekend), even if I wasn't actively looking to buy any of it. I am set for body wash for a while.

Anyway, I am going to start linking up websites I have found to be helpful, and hopefully start making dents with coupons.

Sunday, May 2, 2010

April cash jars

Not a great month in the sinking fund front. We spent a good bit of a weekend cleaning out our basement, and had to get a lot of supplies for that. We had a few expensive grocery trips. I had a work outing. I had a friend obligaion in which I spent a lot of money. We got pizza once. My diet is causing us to cut back on the takeout, but I spent the rest of that money covering shortages in other areas. Lots of schlepping around this month, so I was desperate for gas. I am also doing most of the driving because my husband's tire is flat.

Jar~~~~Spent~~~~Left

Grocery~~388~~~~~~12

Supplies~~71~~~~~~~ -21

Misc~~~~40~~~~~~~~10

Takeout~~50~~~~~~~10

Gas~~~~~125~~~~~~~0

We had $10 left in the end. But I used that money to help cover one of the jars for May. So we ultimately had nothing left for the sinking fund. The upside is I am getting better at giving us just what we need. The downside is less for whatever we are saving it for.

Jar~~~~Spent~~~~Left

Grocery~~388~~~~~~12

Supplies~~71~~~~~~~ -21

Misc~~~~40~~~~~~~~10

Takeout~~50~~~~~~~10

Gas~~~~~125~~~~~~~0

We had $10 left in the end. But I used that money to help cover one of the jars for May. So we ultimately had nothing left for the sinking fund. The upside is I am getting better at giving us just what we need. The downside is less for whatever we are saving it for.

Saturday, May 1, 2010

March Income Statement

March:

March:Income: Standard.

Fixed: Power is still high. Trash bill this month. My husband says they are redoing the trash system here so that it will be included in property tax and will also pick up more recyclables, which will be fabulous. They tried this last year, and it failed, so we are hoping it passes this year. Water was high. We have some plumbing problems we haven't addressed yet, and some leaky toilets. But, it's only like $5 more than usual... Our insurance (car) was crazy low this month. With all the roof stuff, my husband also spoke with them about some discounts he thought we should be getting, and reduced our price. I guess they were crediting us back or something? I really don't know.

A note on Bally's: I have started going back. I am trying hard to lose weight (for the wedding, and pre-baby) and am working out 4 days a week now. 2 at Bally and 2 at the gym at work. I'd like to also do wii fit on the weekends, but haven't gotten to do that yet. It's been pretty busy. I have lost 4 pounds so far. So, I am keeping Bally's for now.

Debt: Paid off my credit card. I now own a lot of veterinary work and all my dollstuffs and my transmission. Only $1000 to cc5, to allow for us to save for the roof repair. Minimums all around.

Variable: My car renewal was due. Two cats got shots. The repair is for the power guy who came out when my house lost power. I spent some extra money going out with work and friends this month. Bank fees are finance charges, as usual. Our Misc. was high this month, too, and I don't remember why now. (my book is downstairs)

Saving: $59 to sinking fund. $900 for the roof.

Highly unusual expenses which get their own category this month: My husband spent money to be with and help out his parents. They paid him back for this (but not until April). I bought and mailed invitations for my cousin's rehearsal dinner, which I had budgeted money for. I also bought shoes for my dress.

And, we still made it out with $20 to spare.

Labels:

baby,

budget,

debt,

expenses,

Income statement,

March,

money,

numbers,

paying off,

repairs,

savings,

spending,

weight loss

Friday, April 23, 2010

Payoff Month 4

| March: |

| cc1,2,3,4: 0 |

| cc5: 6048.51 |

| Loan1: 4637.26 |

| Loan 2: 11477.91 |

| Loan 3: 12351.85 |

| Debt: 34515.53 |

| Paid last month: 1424.72 |

April

cc 1,2,3,4: 0

cc5: 6105.14 *

Loan 1: 4542.19

Loan 2: 11437.74

Loan 3: 11401.28 **

Debt: 33486.35

Paid: 1085.81

Total Paid: 10421.53

* Yeah, I know that is higher this month. Here's the deal. When my husband went to take care of his parents, he had to buy them a lot of stuff and run a lot of errands for them, plus buy the plane ticket. He used his credit card. His dad has since paid him back, but that isn't going to show up until the next statement. So, while that is a false total, it is what it is, and I am dealing with printed statement totals. About half of that should be gone next month.

** This is the loan to my father. I have done some reworking and decided to pay this off before my other student loan. Doing so not only allows me to hit my student loan fast and hard (because my payment to my dad is higher) but also allows me to pay my dad off by the end of the year, which is really appealing. The total owed changes, then, because I will owe less interest to him in the end, so this is lower than it was for those reasons.

So, while not a great month in the payoff department, we did surpass $10,000 paid, we are still on track for our payoff dates, and we should show some big losses in next month's report.

Thursday, April 15, 2010

Mid month update

Happy tax day!

We had to pay $2000. But we are also getting $800 back from the state. Had to dip into savings for this. I think this has something to do with our mortgage set up right now. If'n we refi soon, maybe it will straighten itself out. I have tabled the refi for now.

We have had an estimate for our roof, and another one coming next week. They think it was a bullet! I forget exactly, but it was around $850. The people coming next week can also do our siding repair (which is probably from settling), so I am waiting to see what that looks like. We have about $1000 saved for this, and I want it done already.

Counting down to my cousin's wedding. I get an extra paycheck this month, which should cover the hotel. We also have $200 in the travel fund, and the $400 in the sinking fund to cover any other expenses. I don't expect many, but we will have parking and miscellaneous spending. I still need to get a gift, too.

My husband needs new tires. Like, one if his tires is literally completely flat. I still haven't worked out how we are going to pay for this.

The good news is, my husband's boss called him last week and gave him a promotion and an 8% raise. It seems to amount to about $360 more take home a month. It was shocking how quickly I found places for that money to go. I had so many things I wanted to fund, and hadn't yet, that the whole thing is not going to debt repayment, as I might like. Starting in May, We will begin a car fund. Both our cars are old, and I am holding my breath that they will both make it another year (let alone long enough to save for another one). My husband's car is ten years old and has over 150,000 miles. I gave us each a raise in our personal money. I think we deserve it. We have had very little fun money. Now we are up to an amount we can actually use for something we want. I doubled what we are saving for our lawn boy - both because we are going to start needing him again, and because I expect his rates to increase again this year. The rest seems to be ironing out things that were getting ignored in the budget, such as the bills being charged on our cards and the quarterly bills. It doesn't last long. But it is good to have. I am just disappointed, because somehow I thought we could get our debt repayment up to 2900 a month, but I guess that was not a realistic figure. I was not accounting for things properly.

I am also struggling with the fact that I am "saving" about $500 a month into these funds. I could pay things off faster if I didn't. But I feel better knowing that we are building money towards these things, should they happen. Our travel and pet funds are about to take another hit. The repairs we have are outpacing what I am saving for them by far. I have decided to put caps on some of these things. If I manage to hit the cap, then I can cut back the saving there until I have to use the money.

We had to pay $2000. But we are also getting $800 back from the state. Had to dip into savings for this. I think this has something to do with our mortgage set up right now. If'n we refi soon, maybe it will straighten itself out. I have tabled the refi for now.

We have had an estimate for our roof, and another one coming next week. They think it was a bullet! I forget exactly, but it was around $850. The people coming next week can also do our siding repair (which is probably from settling), so I am waiting to see what that looks like. We have about $1000 saved for this, and I want it done already.

Counting down to my cousin's wedding. I get an extra paycheck this month, which should cover the hotel. We also have $200 in the travel fund, and the $400 in the sinking fund to cover any other expenses. I don't expect many, but we will have parking and miscellaneous spending. I still need to get a gift, too.

My husband needs new tires. Like, one if his tires is literally completely flat. I still haven't worked out how we are going to pay for this.

The good news is, my husband's boss called him last week and gave him a promotion and an 8% raise. It seems to amount to about $360 more take home a month. It was shocking how quickly I found places for that money to go. I had so many things I wanted to fund, and hadn't yet, that the whole thing is not going to debt repayment, as I might like. Starting in May, We will begin a car fund. Both our cars are old, and I am holding my breath that they will both make it another year (let alone long enough to save for another one). My husband's car is ten years old and has over 150,000 miles. I gave us each a raise in our personal money. I think we deserve it. We have had very little fun money. Now we are up to an amount we can actually use for something we want. I doubled what we are saving for our lawn boy - both because we are going to start needing him again, and because I expect his rates to increase again this year. The rest seems to be ironing out things that were getting ignored in the budget, such as the bills being charged on our cards and the quarterly bills. It doesn't last long. But it is good to have. I am just disappointed, because somehow I thought we could get our debt repayment up to 2900 a month, but I guess that was not a realistic figure. I was not accounting for things properly.

I am also struggling with the fact that I am "saving" about $500 a month into these funds. I could pay things off faster if I didn't. But I feel better knowing that we are building money towards these things, should they happen. Our travel and pet funds are about to take another hit. The repairs we have are outpacing what I am saving for them by far. I have decided to put caps on some of these things. If I manage to hit the cap, then I can cut back the saving there until I have to use the money.

Thursday, April 8, 2010

April Budget

April Budget

Fixed

I anticipate a drop in power this month. We have taken out life insurance, so I expected to pay about an additional $60 in the insurance category a month, starting in April.

Debt

Cards 1-4 are paid off, so we are pounding on my husband's credit card now.

Variable

I can finally start my travel fund. Continuing the repair fund. Everything else appears to be the same as any other month.

Short and sweet :)

March budget

Here is my March budget. I couldn't find the one I printed out in February, and I think I messed with the spreadsheet a lot since then, but this is still pretty close to our plan.

Fixed

I was still anticipating a high power bill. Lower cable. I added the server back in - They were offering us half what we were paying before and we were having a lot of trouble with reliable connection from home, so we were considering going back. As of this writing, we still have not, but I have it in there just in case. Our trash bill was due this month. I took out some of the other quarterly expenses because it was just confusing me. Both on the budget and the bank account. I know you are supposed to save the month's portion each month, but it is just not working for me, so I am going to try to just recognize the bill when it comes due. I also removed the bills which are charged to my husband's card, because now we are just paying on that card, and I don't really have to account for the extra to keep the balance even. I will either add those back in when his card is paid off or encourage him to have them taken from the bank account instead.

Debt

I struggled with this a lot. I had wanted to pay my credit card off in Feb and then put $2000 to my husband's card. We would have had it paid off in May then. With the various crises that arose, I felt it more prudent to hold some money back for a couple months to help pay for stuff. So, we planned to pay off my credit card in March and only $1000 to my husband's. Minimums on all else.

Variables

My car came due, so I had to pay my taxes and emissions. I was so aware of it because of the budget, I think this is the first year ever I had it done weeks ahead of time. Two of our cats were due for shots, so I upped our pet allotment to cover that. I added a new fund for repairs, with the $400 held back from debt for the month (plus the $500 from last month).

Wednesday, April 7, 2010

February income statement

February income statement

Revenue

I got an extra week's pay in one of my paychecks. My husband deposited some birthday money. I believe some of the bank balance is for our March mortgage, but I am not quite sure. It just seems high to me.

Fixed

Power was super high. Just look at that. Ugh. We had some snow and some very cold days. We are finally seeing the lowered cable price, though that does include a partial refund for the month, so future cable should be around $80. I still think that is super high for the basic stuff. We had our termite bill for the quarter.

Debt repayment

Just when I thought #2 was paid, it hit me with a $5 interest charge from the previous month. I now have that paid off again. I own my carpet (#3). We paid off most of cc#4 which is my main card. I was going to pay the whole thing, but then the fiasco with the roof, and I opted to save some money for that instead. That was a very hard decision to make. Minimums to all else.

Variable

Most of these are discussed in the cash jar post. Some highlights: Pet. Is very high, because we adopted our dog, and purchased items for him. This figure includes the money we also still set aside for the pet jar. The only thing I can say for myself, is I did that all with cash. Mostly money from my extra paycheck that month. We bought our convention tickets for this summer, so that is set. Bank fees are finance charges. Other than the dog, we really stuck to (or below) our budget for this month.

Savings

We added $120 to the sinking fund from the cash jars for the month. We saved $500 towards our roof repair, instead of paying off a credit card.

Looking back, I am not sure I calculated the bank balances properly, and we way overspent on the pet category (and power!) but we came out positive and did really well overall, I think.

Saturday, April 3, 2010

March cash jars and memoriam

March was hard. That may have something to do with my lack of updates this month. Again, I hope to get everything caught up in the next few days. We don't have a lot of money left over, and it is actually more than I initially thought. I think in part, the fact that it was a five week month made it hard to get through. We also had some "lost" money, where we pulled money from whatever jar had it and we now don't know where it went.

The month started with my husband getting his crowns. Luckily, we were able to use our health flex card to pay for those. So, we don't feel the hit from that, but it used the most of our health allocation for the year.

Two of our cats got their shots. My husband forgot to get cash from the jar for that, so he used the debit card. He also spent more than I was expecting.

Then my husband flew off to Texas to take care of his family for two weeks. His mom came through her lung surgery and the biopsy said it isn't cancer.

We had someone out to look at our roof. The roof of the house is in good shape, but the porch roof needs to be replaced. The insurance won't cover it, but it will probably cost less than the deductible anyway.

Our house lost partial power last week while I was here on my own. I was freaking out, imagining walls getting knocked out and rewiring and cost and everything. I had an electrician out, and had to pay $120 for that. He determined it was a problem for the power company. They came right out, dug up my front yard, and did something to cause the power to come back, and I didn't have to pay anything further.

This was a "make it work" month.

Jar~~~~~Used~~~~~Left

Gas~~~~~~125~~~~~~~~0

Grocery~~~378~~~~~~~~20

Take out~~60~~~~~~~~~0

Misc~~~~~47~~~~~~~~~3

Supplies~~24~~~~~~~~~26

Unknown~~~~~~~~~~~~10

Add to sinking: 59

The month started with my husband getting his crowns. Luckily, we were able to use our health flex card to pay for those. So, we don't feel the hit from that, but it used the most of our health allocation for the year.

Two of our cats got their shots. My husband forgot to get cash from the jar for that, so he used the debit card. He also spent more than I was expecting.

Then my husband flew off to Texas to take care of his family for two weeks. His mom came through her lung surgery and the biopsy said it isn't cancer.

We had someone out to look at our roof. The roof of the house is in good shape, but the porch roof needs to be replaced. The insurance won't cover it, but it will probably cost less than the deductible anyway.